hawaii capital gains tax on real estate

Capital gains are currently taxed at a rate of 725. Any property dispositions on or after the 15th of September that do not qualify for an exemption will now be subject to a 75 withholding rate.

Do You Have To Pay Capital Gains Tax On Property Sold Out Of State

House members take their oaths of.

. You are subject to Hawaii capital gains tax of up to 725 on the profit gain realized on the transaction. Get Access to the Largest Online Library of Legal Forms for Any State. This replacement property needs to be a property used for the purpose of.

When the seller is not a. Increases the capital gains tax threshold from 725 per cent to 9 per cent. This is 725 of the sales price from the seller when the seller is an out-of-State resident.

Its 500000 for those married filing jointly How much is capital gains tax on sale of property. This is a Hawaii State law that requires a withholding of 725 of the sales price. If you sell your investment property and want to roll it into a new real estate investment have the investment you want to buy ready when youre set to sell.

Is capital gains tax 30. Hawaii Department of Taxation will want at closing 5 percent of the sale. When you live out of state and you sell property in Hawaii the transaction may be subject to tax withholding.

The Hawaii capital gains tax on real estate is 725. Kind of property and description Example. Youll need to move the earned money into that property within 180 days or youll have to pay capital gains tax.

100 shares of Z Co b. 2016REV 2016 To be filed with Form N-35 Name Federal Employer ID. The current top capital gains tax rate is 725 which critics point out is a lower tax rate than many Hawaii residents pay on their wages and salaries.

You are subject to Hawaii capital gains tax of. If you sell the home you live in up to 250000 of the profit is is excluded from taxes. Hawaiʻi is one of only nine states that taxes all capital gainsprofits from the sale of stocks bonds investment real estate art and antiquesat a lower rate than ordinary income.

Increased from 5 as of 2018 725 of the sales price not 725 of the gains realized. Hawaii taxes gain realized on the sale of real estate at 725. GET and Transient Accommodation Tax TAT of 1025-1050 is due on all short term rentals of under 180 days.

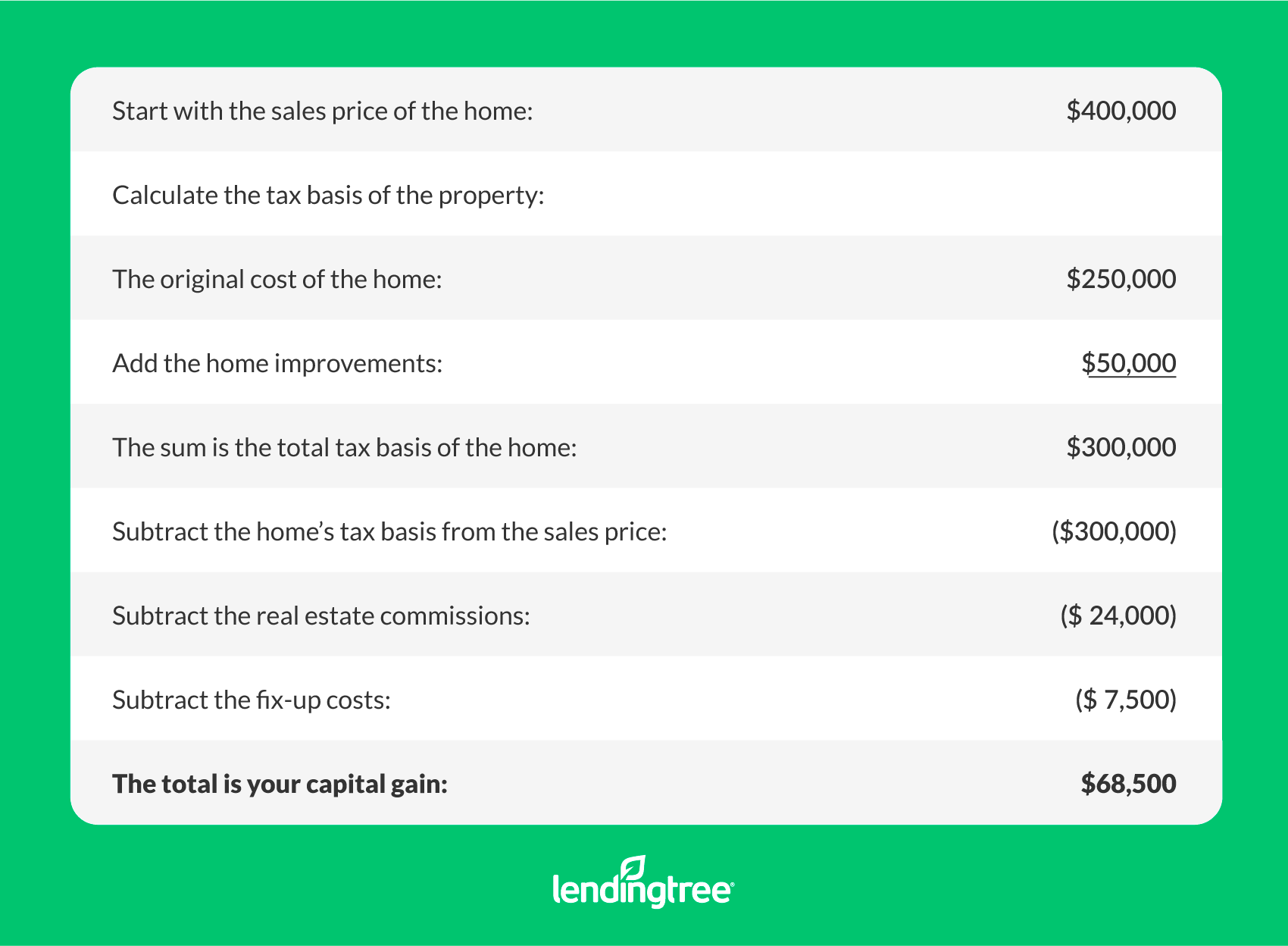

This is not a tax. You can defer paying capital gains tax on the sale of an investment or business property if you use the proceeds of the sale to purchase a similar property replacing the one you sold. What is the actual Hawaii capital gains tax.

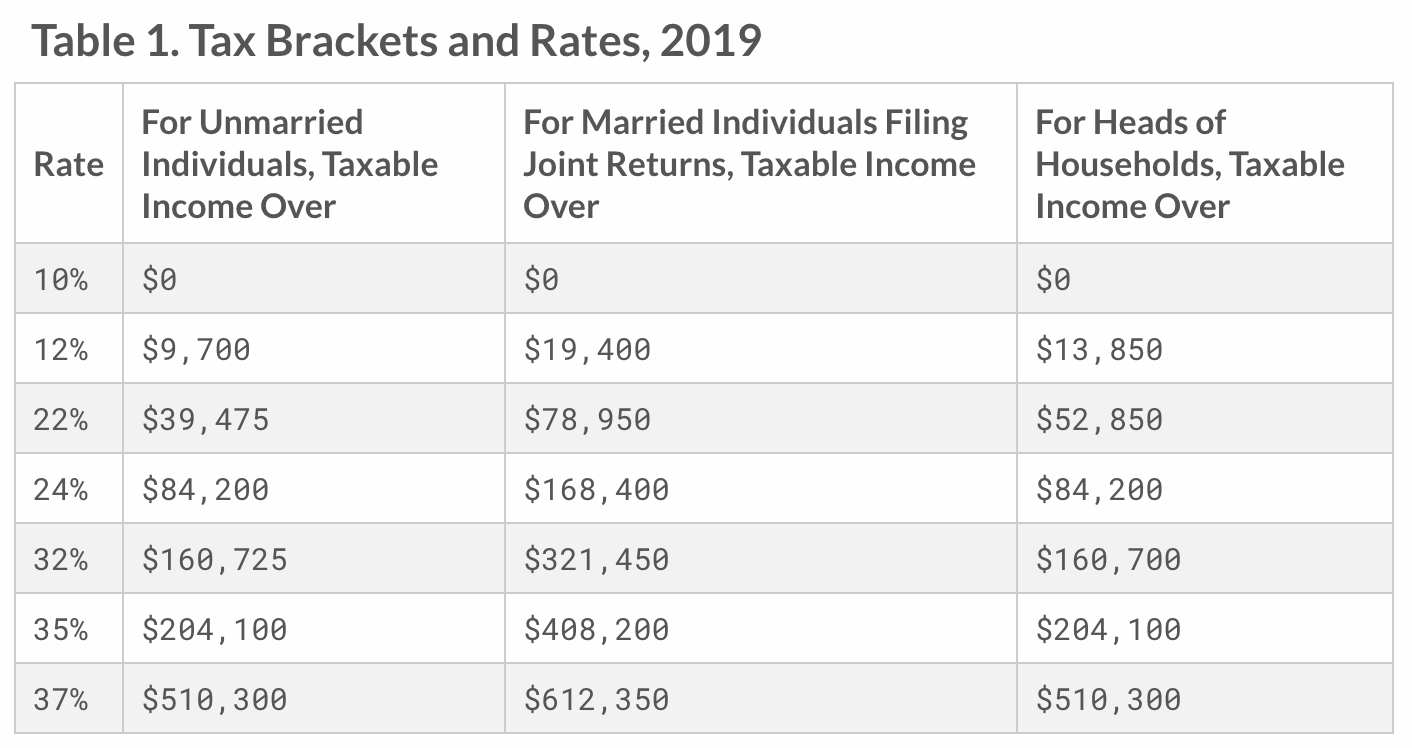

The current capital gains tax of most investments is 0 15 or 20 of the profit depending on your overall income. Effective for tax years beginning after 12312020. STATE OF HAWAIIDEPARTMENT OF TAXATION SCHEDULE D FORM N-35 Capital Gains and Losses and Built-in Gains.

Generally only estates worth more than 5490000 must file an estate. Hawaii General Excise Tax GET of 400-450 is due on all long term rental of over 180 days. In Hawaii and especially in Maui Real Estate the 1031 exchange is a very popular and common way to purchase real estate.

Statement of Withholding on Dispositions by Nonresident Persons of Hawaii Real Property Interests. Effective for tax years beginning after 12312020. Increased from 5 as of 2018 725 of the sales price not 725 of the gains realized.

Inheritance and Estate Tax and Inheritance and Estate Tax Exemption. Hawaii has determined that 725 of the sales price provides a reasonable approximation of the capital gains tax that may be due Hawaii from the sale. Ad The Leading Online Publisher of National and State-specific Legal Documents.

7 rows Hawaii Withholding Tax Return for Dispositions by Nonresident Persons of Hawaii Real Property Interests. 1 HARPTA is an acronym for Hawaii Real Property Tax Act. PART I Short-Term Capital Gains and Losses Assets Held One Year or Less a.

Besides capital gains tax the depreciation recapture tax gets added to the tax bill. Convert from Investment Property to Principal Residence. Application for Withholding Certificate for Dispositions by Nonresident Persons of Hawaii Real Property Interests.

7 Great Tax Benefits Of Investing In Real Estate Physician On Fire

We Buy Houses Fast We Buy Houses Sell House Fast Hawaii Real Estate

State Taxation As It Applies To 1031 Exchanges

Real Estate Tax Loopholes Secrets Evergreen Small Business

How To Buy Land In The Philippines How To Buy Land The Deed Philippines

Pin On Charts Graphs Comics Data

State By State Guide To Taxes On Retirees Kiplinger

State Taxation As It Applies To 1031 Exchanges

Monday Map State Local Property Tax Collections Per Capita Tax Foundation

Harpta Explained Harpta Refund Solutions

7 Great Tax Benefits Of Investing In Real Estate Physician On Fire

Hours Worked Advanced Economy Graphing Employment

The Ultimate Guide To Hawaii Real Estate Taxes

Capital Gains On Home Sales What Is Capital Gains Tax On Real Estate Guaranteed Rate

Do You Have To Pay Capital Gains Tax On Property Sold Out Of State